Focus on the right businesses, personalize messaging, and automatically engage with people, making your sales and marketing teams focused and effective.

Banking

See the value 6sense brings to your role

Marketing

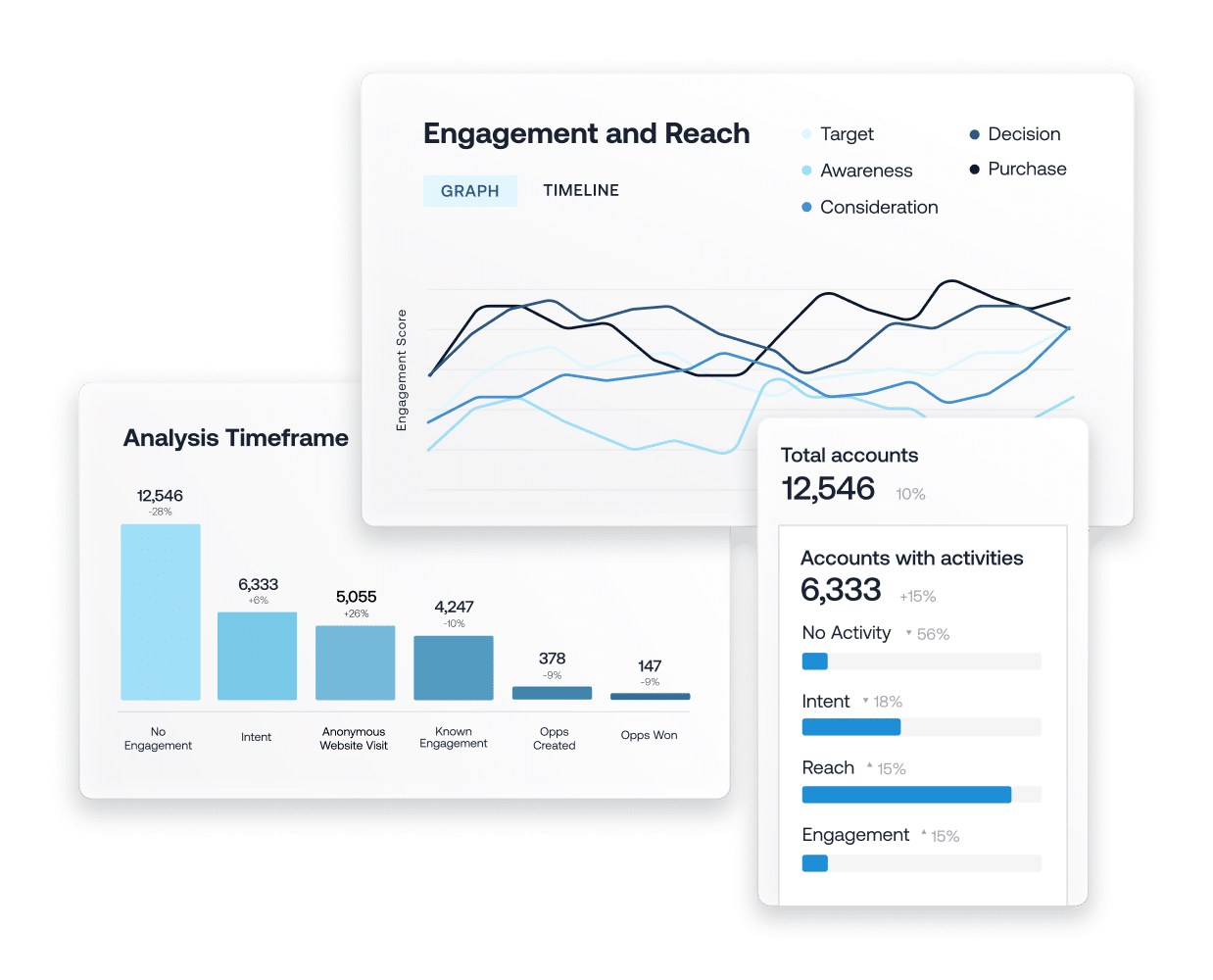

Insights to drive your targeting

Focus your marketing efforts on firms actively researching banking products, not just on your website, but on 3rd party sites.

Personalize messaging for marketing campaigns

Make sure you’re targeting the right messages to the right businesses based on their intent. For example, ensure a business seeking corporate cards sees content about your payment products.

Drive tighter alignment with bankers

Ensure sales and marketing are targeting the same people, provide contact and account intelligence to sales teams, and automate personalized 1:1 communication.

Sales

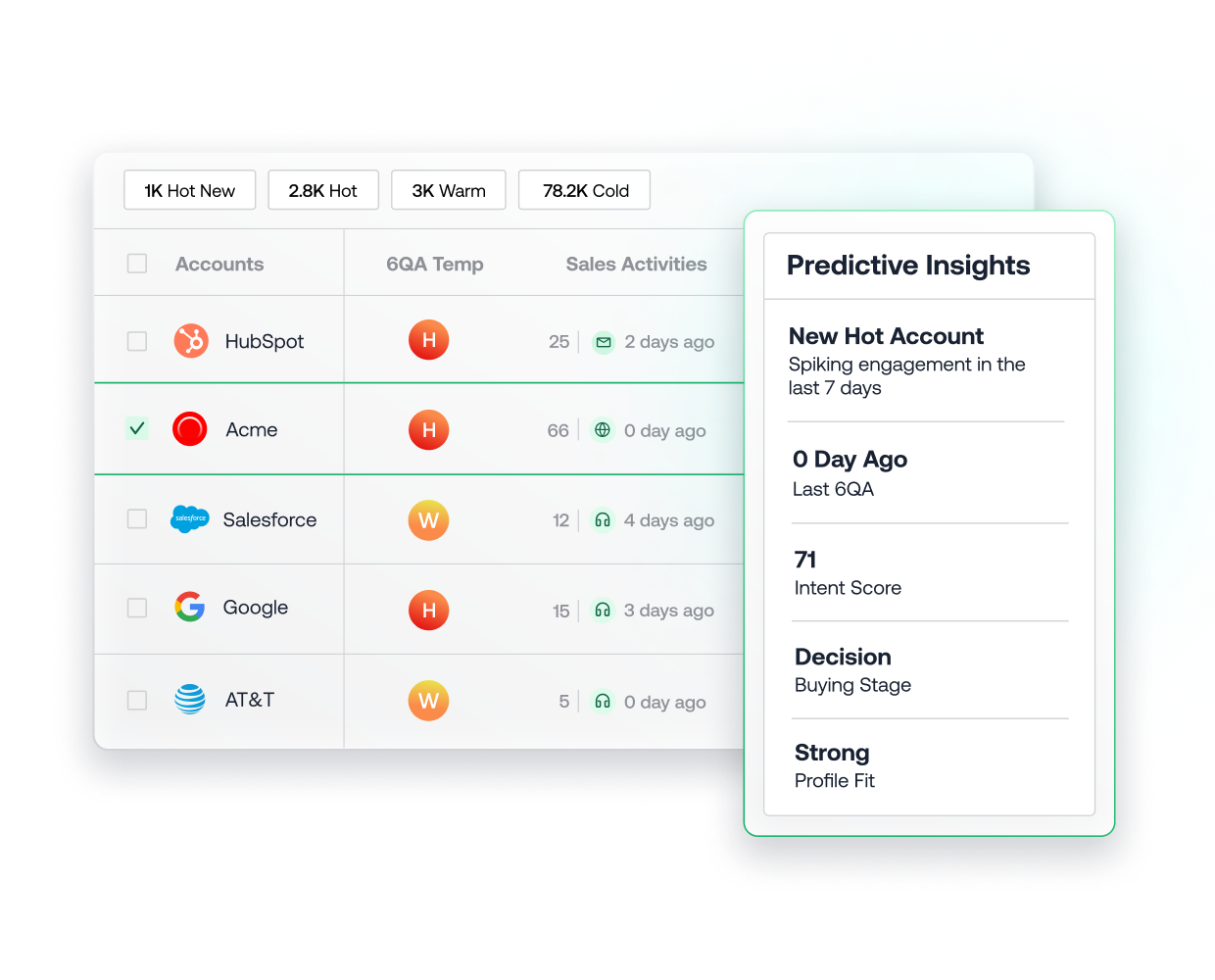

Reach people seeking to switch or diversify banks

Capture data on your targets’ online research to identify who’s actively in-market. The days of spending time with the wrong people are over.

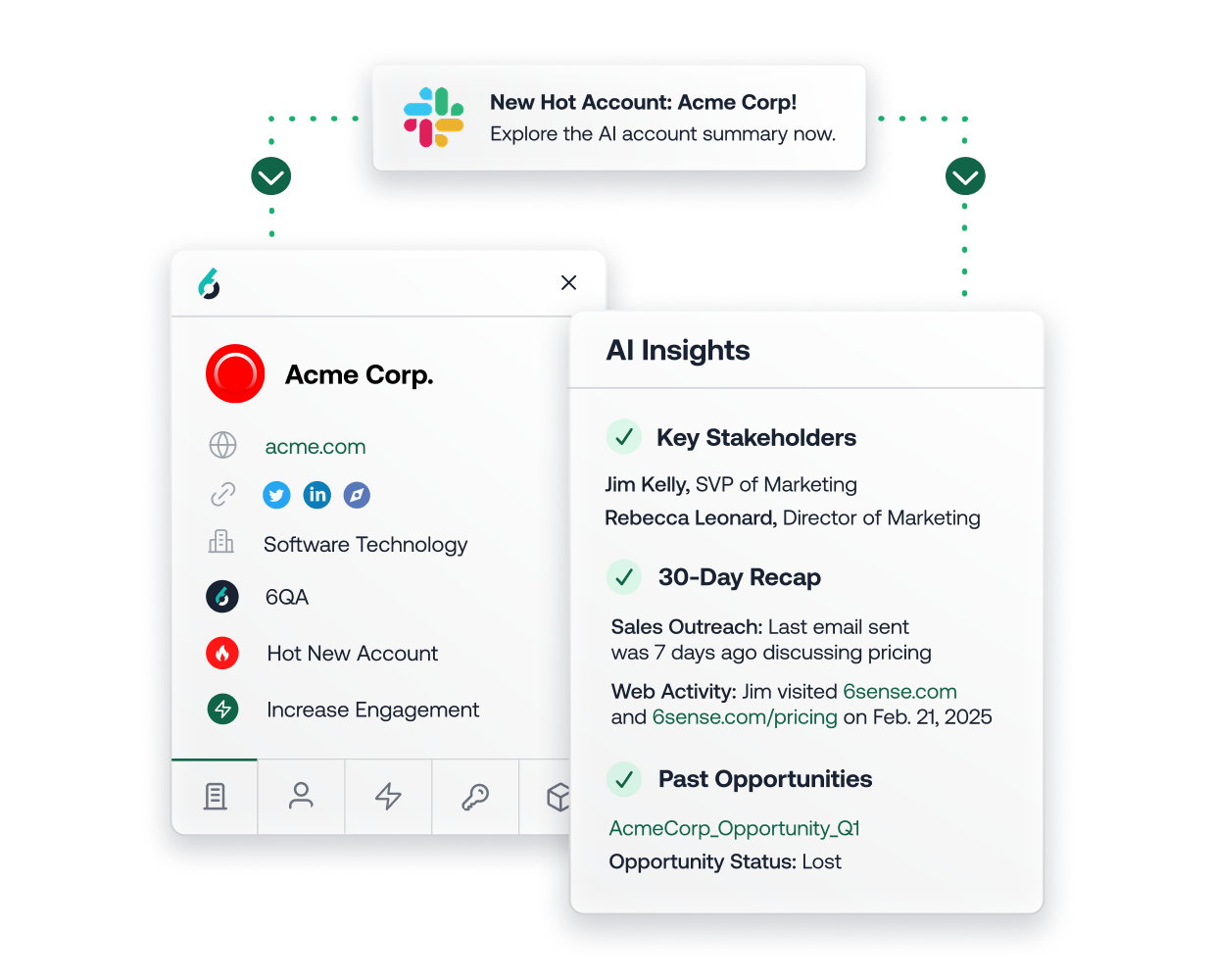

Use AI to personalize communications

Our data will tell you what a business has been researching what banking products they might be interested in (even if they haven’t been to your website). Leverage that data to automatically write communications that will capture their attention.

Spend more time working deals & less time prospecting

By focusing on people that are in-market, personalizing and automating communication, and unlocking contact data, it’s easier than ever to get meetings with businesses that are likely to switch banks.

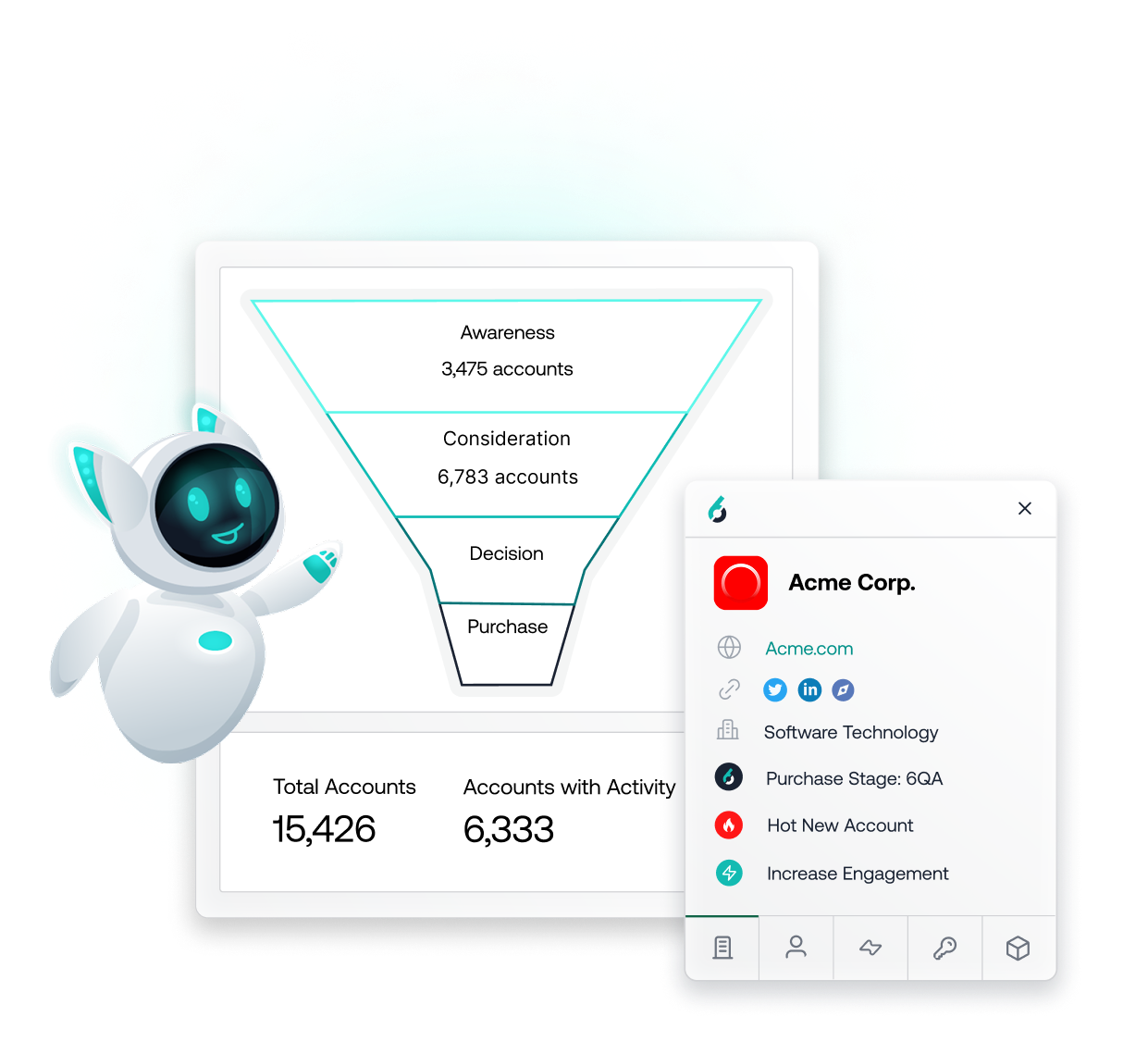

Understand the buying journey

6sense proactively identifies anonymous buying signals, like keyword research, across various users, devices, and channels, to match them back to the companies they work for.

These insights give you a fuller picture of what’s going on in the buying journey, so your team can tailor your sales and marketing efforts.

Prioritize your sales team

6sense prioritizes and provides key contacts that your teams should be engaging with to win more business. Create seamless, personalized outreach to AI-prioritized contacts so your team is only spending time with clients ready for your solutions.

Frequently asked questions

What is account-based marketing (ABM) for banking?

Account-based marketing (ABM) for banking is a targeted approach that focuses on specific high-value clients or accounts. This is due to the B2B buying process involving more stakeholders than consumer services. It tailors marketing efforts to the holistic account’s unique needs, enhancing personalization and increasing the likelihood of conversion within business and commercial banking.

What is B2B marketing for banks and financial institutions?

B2B marketing for banks involves promoting financial products and services to a specific target audience. It includes strategies to build trust, educate clients, and drive engagement in a highly regulated industry.

How to create a marketing strategy plan for banks?

To create a marketing strategy for banks, identify your target audience or ideal customer profile (ICP), create content that resonates with your ICP(s), understand industry regulations, and use digital channels to reach your target accounts at the right time, and continually test and optimize your approaches.